- #PEACHTREE ACCOUNTING SOFTWARE MAC FOR MAC#

- #PEACHTREE ACCOUNTING SOFTWARE MAC PC#

- #PEACHTREE ACCOUNTING SOFTWARE MAC MAC#

For example, Xero is a popular online accounting software that is optimized for PC and Mac.

#PEACHTREE ACCOUNTING SOFTWARE MAC MAC#

Businesses also find PCs to be a more cost-effective option for running accounting software.īecause of the prevalence of PCs in the workplace, software developers looking to capture both PC and Mac users will create full-featured online and cloud-based options that run easily on both. PCs are considerably cheaper than Macs, which plays a big part in their popularity. Net Applications found that only 10% of active personal computers were Macs. Accounting solutions developed for Macs often have limited functionality compared to similar options on PC.ĭevelopers tend to focus their efforts on PCs because PCs are more common. This is because the vast majority of solutions are built with PCs in mind.

#PEACHTREE ACCOUNTING SOFTWARE MAC FOR MAC#

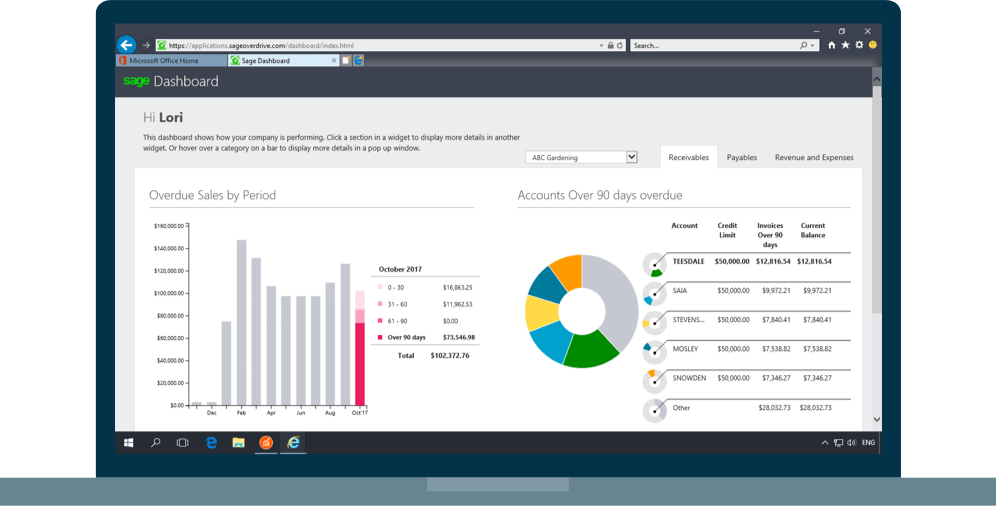

Small Business Accounting Software for Macįinding a reliable small business accounting software for Mac platforms can be a challenge. Examples of Popular Small Business Accounting Software A company will understandably want to save on their first software purchase and will need a user-friendly option that someone without an accounting background can learn quickly. Small businesses need an affordable, easy to use solution. Types of Small Business Accounting Software The Sage 50c Business Status page shows your account balances, revenue, vendor payments, outstanding invoices, and more. Fixed Asset Management: Automates the calculation of depreciating asset value with standard or custom decay models.The cost of goods sold is also tracked on the income statement. Inventory Management: Inventory is recorded as current assets on your balance sheet.Payroll: Manage employee compensation including wages, check printing, ACH deposits, and compensation tax reports.Creates reports such as profit and loss statements and balance sheets. General Ledger: Records financial activity including transactions and account structures.Accounts Receivable: Track income by monitoring the money you received or are owed from invoicing.Accounts Payable: Track expenses by monitoring the money you paid or owe.Features of Small Business Accounting Software QuickBooks Online provides a dashboard to view your profit and loss, expenses, bank accounts, and more. Some solutions are scalable and will let you add these functionalities on at a later date. Small businesses will usually only require core accounting features such as accounts payable for tracking expenses, accounts receivable for creating customer invoices, and a general ledger that creates profit and loss statements and balance sheets.Ī growing small business may also look beyond basic income and expense tracking, desiring additional functionalities such as payroll services, inventory management, and fixed asset management. By tracking income and expenses and determining profit and loss, businesses can improve their cash flow through an affordable and easy to use platform that allows them to spend the least amount of time entering data. Small business accounting software manages financial transactions at a lower cost of entry. What is Small Business Accounting Software?

Most small businesses may opt for a simple out-of-the-box software that does not require any additional add-ons or customization. Since accounting software is something your small business will use everyday, it’s important you choose one that is easy to use, easy to implement, and within your budget. The best small business accounting software will track your financial transactions to record profit and loss as accurately as possible–all while giving a clear view of your profitability.

0 kommentar(er)

0 kommentar(er)